Table Of Content

It also specifies a maximum loan amount—based on your financial picture—to help you narrow down your home-buying budget. This is why it’s crucial to avoid any financial moves after preapproval that could make you appear riskier to lenders. Things not to do during mortgage preapproval include applying for new credit, making large purchases or missing loan and credit card payments.

Mortgage Tools

Low Income Home Loans For 2024 First-Time Home Buyer - The Mortgage Reports

Low Income Home Loans For 2024 First-Time Home Buyer.

Posted: Thu, 04 Jan 2024 08:00:00 GMT [source]

If you are, you’ll be issued a preapproval letter stating the loan amount and maximum home purchase price you were approved for, along with the preapproval expiration date. Credit card issuers can deny your credit card application even if you’re preapproved or prequalified for the card. Preapproval and prequalification rely on a soft credit inquiry and self-reporting, while official card applications further examine the details of your credit profile through a hard credit inquiry. It’s possible to meet the initial criteria for prescreening while failing to meet other requirements to qualify for a card. Getting preapproved for a mortgage is a crucial piece of buying a house in California (or anywhere, really).

Biden says the US is rushing weaponry to Ukraine as he signs a $95 billion war aid measure into law

Form 8821 authorizes your lender to go to an IRS office and examine the forms you designate for the years you specify, free of charge. An inventory of any judgments, liens, past bankruptcies or foreclosures, pending lawsuits, or delinquent debts. You’ll also be asked to state whether you’re a U.S. citizen or permanent resident and whether you intend to use the home as your primary residence. Preapproval and prequalification are similar terms but different in crucial ways. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity.

What Are the Chances of Getting Denied a Mortgage After Pre-approval?

In California, it’s important to note that the state requires a property to undergo a natural hazard disclosure, which alerts buyers to potential natural hazards such as earthquakes, wildfires, and flooding. The next step in the homebuying process in California is making an offer. An offer involves submitting a written proposal that includes the purchase price, any contingencies or conditions, and a proposed closing date. Negotiating the terms of the sale can take several rounds of back-and-forth communication between you and the seller, so it’s important to be patient and flexible throughout the process. Your credit history is the foundation of mortgage preapproval because it determines your creditworthiness.

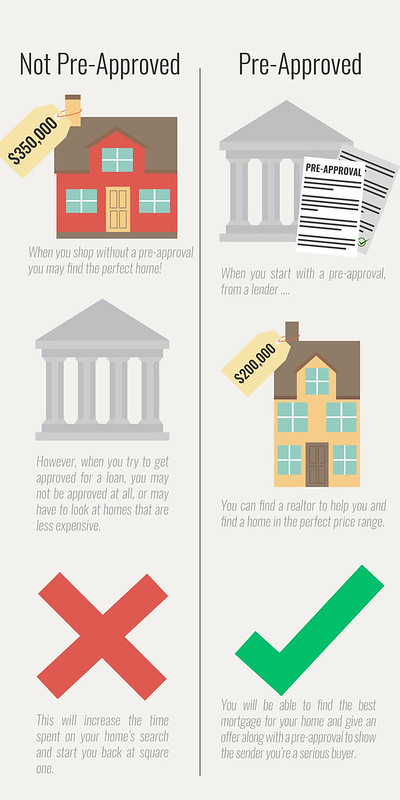

A preapproval tells sellers you can get financed for the amount you’ve offered. Simply getting a preapproval before you start looking at properties doesn't guarantee you’ll get approved. Your lender, will need to review property details for a home loan approval.

If you used a tax preparer or tax software to file your taxes, they might also have copies.

Keep in mind that getting a Verified Approval with Rocket MortgageⓇ will follow some of these same steps when it comes to assessing your financial situation. We will look at your DTI and credit score to ensure you’re qualified for a home loan. Explore our guide to learn what might help increase your mortgage preapproval amount.

If it’s an issue you can remedy, like an error on your credit report that’s causing the lender to reject your application, you can address that right away and seek preapproval again when it’s resolved. Preapproval letters are valid for a specific period, so don’t wait too long after receiving your preapproval to go house-hunting. If your financial situation changes drastically or the home you want doesn’t pass an inspection, you might not get the mortgage you were preapproved for. Depending on the mortgage lender you work with and whether you qualify, you could get a preapproval in as little as one business day, but it usually takes a few days or even a week to receive. And if you have to undergo an income audit or other verifications, it can take longer than that. For most buyers, getting preapproved for a mortgage is vital as it gives you a solid idea of how much you can borrow.

The mortgage that the lender ultimately extends will depend on the exact conditions at the time the buyer needs the funds. Since prequalification doesn’t verify financial data, identify red flags or address potential issues, it won’t improve a buyer’s standing with the seller’s team. Buyers have more to gain from focusing on preapproval, which will take more time but actually impacts the purchase effort.

4 Ways Mortgage Lenders Can Help You Buy a Home - Realtor.com News

4 Ways Mortgage Lenders Can Help You Buy a Home.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The average down payment on a new home in California was $103,000 in the spring of 2022. That’s a staggeringly high sum if you’re on a tight budget, but you probably don’t need that much cash to buy a place here. With a conventional loan, you’ll need a minimum down payment of 3 percent of the purchase price. For example, if you’re buying a place for $500,000, you would need at least $15,000 (plus enough to cover closing costs). So, the first step of buying a house in California is cutting back on your spending and putting together a strategy for saving up a down payment. Some mortgage lenders recommend reaching out for preapproval as early as 12 months before you plan to buy a home to get a head start on addressing any issues that might come up.

Once your financial information is verified, you'll have a clear idea of how much home you can afford. Getting preapproved before you start your house hunt benefits everyone involved. The credit score needed to buy a house depends on the type of mortgage you’re looking to get. For example, conventional loans usually require a credit score of 620, while FHA loans only require a score of 580. But in most cases, getting denied is due to the buyer’s financial standing being negatively impacted. Examples include a change of employment, a decrease in credit score or accrued debt.

Whether buying a home or doing a refinance, getting preapproved is a crucial step in the process of getting a mortgage. Before you can get preapproved, though, the lender will need to review and verify information about your credit and financial situation. Being prepared with the documents needed for mortgage preapproval will help make the process go more smoothly and quickly. Once your information is reviewed, and the lender has no issues, you’ll get a new preapproval letter with a new expiration date.

No comments:

Post a Comment